NPTEL Cost Accounting Week 2 Assignment Answers 2024

1. The company is incurring losses as selling price is below average cost. The management is thinking of temporary discontinuance of operations. Selling price per unit is Rs. 5, Fixed cost per unit is Rs. 6 and variable cost per unit is Rs. 8. Then it is

- better to continue because the losses are minimized

- better to continue because the profits are maximized

- better to discontinue because the losses are maximized

- better to discontinue because the profits are minimized

- None of the above

Answer :- Click Here

2. In make-or-buy decisions, which cost is irrelevant?

- Fixed overhead costs that will remain unchanged regardless of the decision

- Direct labour costs if the product is made in-house

- Purchase cost if the product is bought externally

- Variable overhead costs incurred if the product is made in-house

- None of the above

Answer :- Click Here

3. Which of these is a Joint Cost Allocation method?

- Fixed Cost units’ method

- Profit value at split off point

- Sale value at split off point

- Variable cost split off point

- None of the above

Answer :-

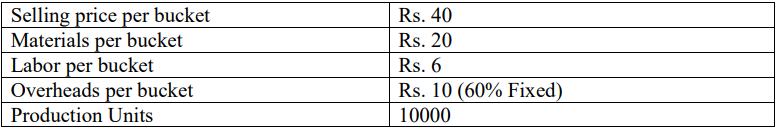

4. Common data for Q4 to Q6: Swastik Ltd. sells bucket. The company has the following expenses and revenues at 40% capacity:

If the company decided to work the factory at 60% capacity, the selling price falls by 3%. If factory work 95% at capacity the selling price falls by 5%.

4. What is the profit or loss if factory work at 60% capacity

- Profit of Rs. 40000

- Profit of Rs. 72000

- Loss of Rs. 72000

- Loss of Rs. 40000

- None of the above

Answer :-

5. Calculate the break-even point in units at 95% capacity

- 7500.0

- 6500.0

- 8000.0

- 7800.0

- None of the above

Answer :-

6. What is the profit or loss if factory work at 95% capacity?

- Loss of Rs. 1,23,000

- Profit of Rs. 1,42,500

- Loss of Rs. 1,30,000

- Profit of Rs. 1,30,000

- None of the above

Answer :- Click Here

7. Common data for Q7 to Q10: Krishna Ltd. maintains a margin of safety of 35% with an overall PV ratio of 25%. Its fixed costs amount to Rs. 4,00,000,

7. Calculate the break-even sales

- Rs. 18,00,666.67

- Rs. 20,66,666.00

- Rs. 16,00,000.00

- Rs. 22,00,000.89

- None of the above

Answer :-

8. Calculate total sales

- Rs. 28,00,330.13

- Rs. 33,33,033.46

- Rs. 24,61,538.46

- Rs. 34,30,303.26

- None of the above

Answer :-

9. What is the current profit?

- Rs. 4,09,385

- Rs. 5,04,835

- Rs. 3,08,435

- Rs. 2,15,385

- None of the above

Answer :-

10. Compute new margin of safety if the sales volume is increased by 9%

- Rs. 12,63,770

- Rs. 10,83,077

- Rs. 11,06,067

- Rs. 13,66,667

- None of the above

Answer :- Click Here